When it comes to securing your family’s financial future, the idea can feel daunting. But here’s the good news: financial security isn’t some far-off, unreachable goal. By breaking it down into small, practical steps, you can build a plan that truly protects your loved ones and gives you peace of mind. Let’s dive into the essential moves you can make to ensure that no matter what life throws your way, your family is financially safe and sound.

Start with an Emergency Fund

First things first, let’s talk about building an emergency fund. Think of this as your financial safety net—ready to catch you when unexpected expenses come along. Car repairs, medical bills, a job loss—these things happen to everyone, and having some cash set aside makes all the difference.

How much should you save? Aim for about three to six months of living expenses. It sounds like a lot, but don’t let that discourage you. Start with what you can manage—even $500 is a solid start. Slowly but surely, keep adding to it. Over time, you’ll build a buffer that keeps life’s little surprises from turning into financial setbacks.

Get Covered: Insurance Matters

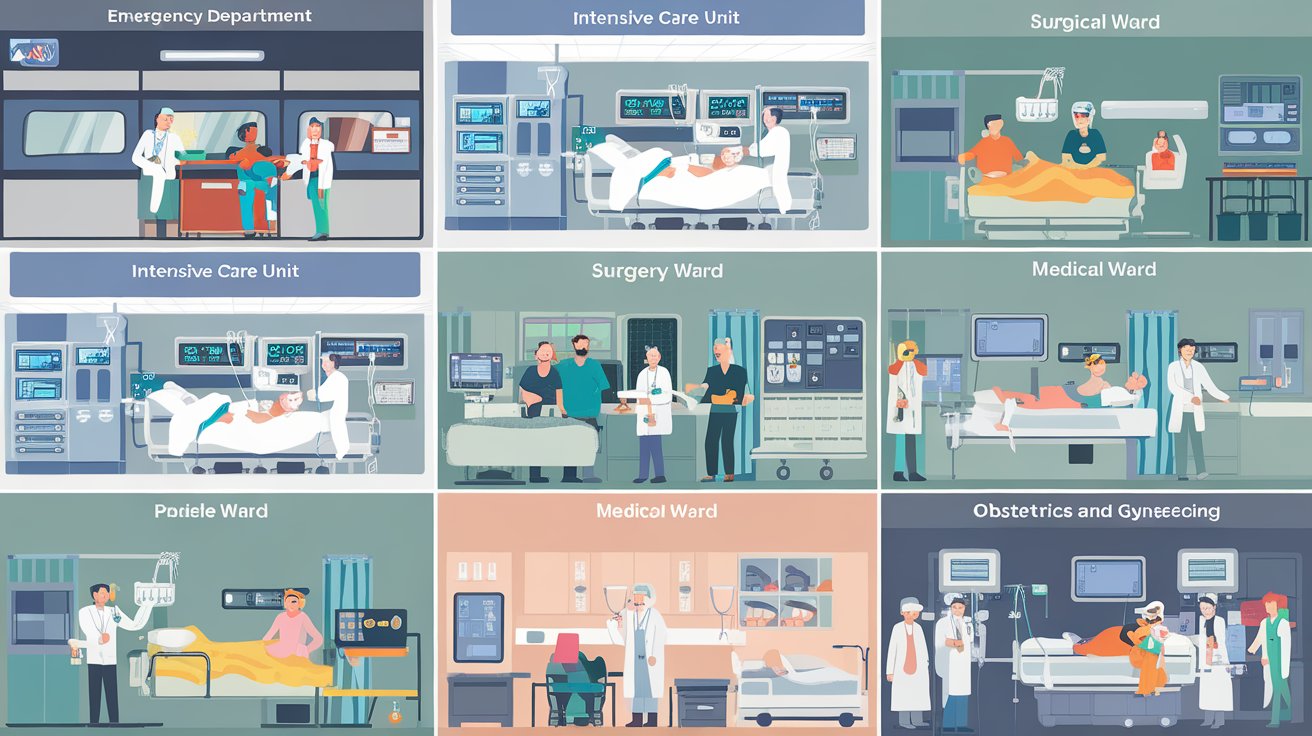

Insurance can feel complicated, but when it comes to protecting your family, certain policies are essential. Life insurance, health insurance, and disability insurance—these are the heavy hitters.

Think about life insurance as a way to make sure your family is financially supported if anything ever happened to you. Health insurance helps cover the inevitable medical costs that arise, and disability insurance protects your income if you can’t work due to illness or injury. When setting up policies, take a look at the details. Are you covered enough to take care of your family if life doesn’t go as planned? And remember, insurance isn’t one-and-done; make it a habit to check in on your coverage every so often to make sure it still meets your family’s needs.

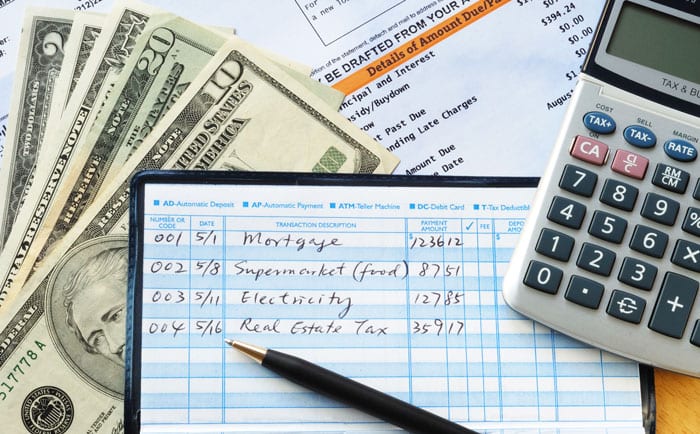

Create a Family Budget and Track Spending

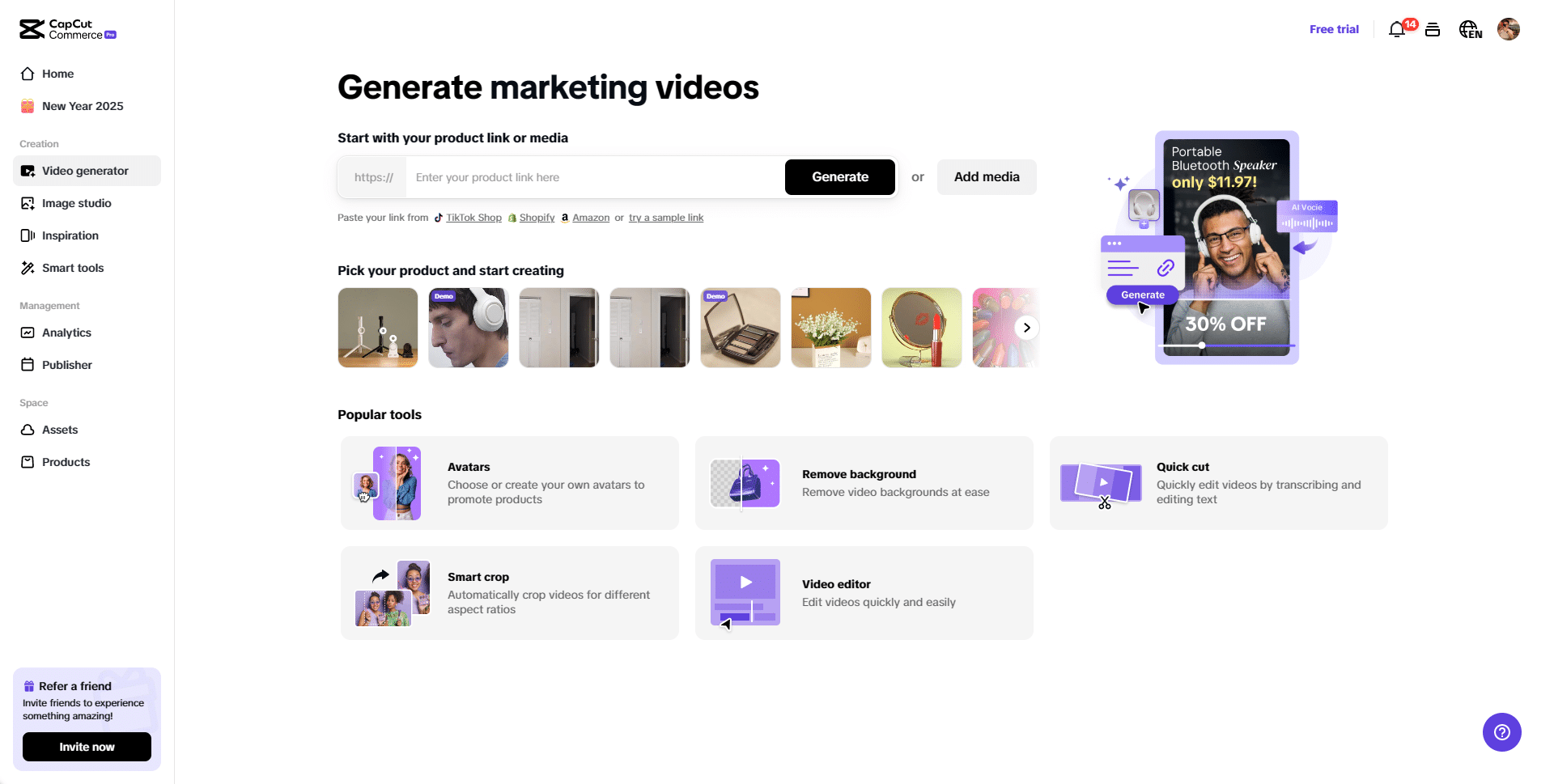

You don’t have to be a financial expert to make a budget. A budget helps you understand where your money’s going and can reveal areas where you can save. Start by listing out your monthly expenses, then compare that to your income. Got a handle on it? Great! You’re already on your way to better financial control.

A simple spreadsheet or a budget planner app can make tracking your expenses easy. And it doesn’t have to be strict. Just knowing where your money is going can help you make adjustments that support your family’s goals, like saving for a vacation or putting more into your emergency fund.

Make Sure You Have a Will and Basic Estate Plans

Planning for the future is key to protecting your loved ones, and that’s where having a will and some basic estate planning comes in. No one loves thinking about this stuff, but it’s essential. A will outlines who gets what and how your assets should be managed if anything happens to you. Plus, having a healthcare directive and a power of attorney means someone you trust will make decisions for you if you’re unable.

This might sound complex, but the process doesn’t have to be overwhelming. Many online services offer simple ways to create these documents, or you can work with an estate planning attorney if you’d like more guidance. In the end, estate planning isn’t just about managing money—it’s about making sure your wishes are respected and your family doesn’t have to guess or deal with unnecessary stress.

Manage Your Debt Wisely

Debt can feel like a heavy weight, but it doesn’t have to hold you back. The key is to prioritize and manage it effectivesly. Start by tackling high-interest debts first, like credit card balances. Thee are the ones that can grow quickly if left unchecked, so paying them down can free up money for other priorities.

If you have student loans, car loans, or a mortgage, consider strategies that make payments easier, like consolidating or refinancing. The goal here isn’t necessarily to pay everything off overnight—it’s to get your debt to a manageable level that doesn’t interfere with your family’s financial security.

Plan Ahead for Education and Retirement

Thinking long-term is part of any solid financial plan, especially when it comes to things like your children’s education and your own retirement. For education, a 529 college savings plan is a great option. Contributions to these accounts can grow tax-free and are earmarked specifically for education expenses.

When it comes to retirement, even small contributions to a 401(k) or IRA add up over time, thanks to compound interest. The earlier you start, the better, but don’t worry if you’re starting later. Just be consistent. The idea is to create a cushion for the future, so you’re not relying on others or stretching your resources thin in later years.

Teach Financial Literacy at Home

One of the best things you can do for your family’s financial future is to make sure everyone understands the basics. Financial literacy isn’t something taught in most schools, so it’s up to you to make it part of family life.

This doesn’t mean giving kids full access to the family budget! But involving them in small ways—like teaching them about saving part of their allowance or explaining why you’re choosing to save rather than spend—can go a long way. When kids grow up understanding how money works, they’re better prepared to make smart decisions down the road. Financial literacy is a skill that will help your family long after they’re grown and on their own.

Taking Action: Putting Your Family First

By now, you’ve got a roadmap to protect your family financially. Start with the basics: set up an emergency fund, make sure your insurance is adequate, and get a will in place. From there, focus on managing debt, saving for the future, and making financial literacy a family affair.

Remember, every step you take is a step toward security, even if you’re starting small. Building financial protection doesn’t happen overnight, but each move you make strengthens your family’s future. And that peace of mind? It’s worth every effort.